Year-ends and holiday seasons inspire many to give – and give generously – to charities. The season also serves as a reminder that lasting legacies can be established through strategic giving, even during adverse economic conditions.

"Obviously, clients are concerned about the downturn in the market and the rising inflation,” says David J. DelFiandra, partner, chair of estates and trusts practice at Leech Tishman. “However, the increase in interest rates make certain estate planning strategies more beneficial right now.”

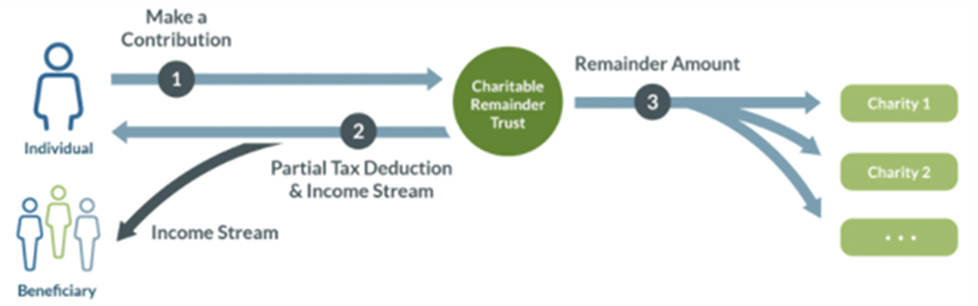

DelFiandra suggests charitable remainder annuity trusts (CRATs) and charitable remainder unitrusts (CRUTs) because they “produce higher charitable income tax deductions for our clients who are considering such vehicles.”

Additionally, the passage of the Secure Act virtually eliminated the Stretch IRA and clients have been replacing their children with a testamentary CRAT or CRUT as the IRA beneficiary. DelFiandra says, “Naming a CRAT or CRUT as the IRA beneficiary with the children as beneficiaries of the Trust prevents the children from having unfettered access to the qualified plan after the clients’ death … The CRAT or CRUT provides an annual annuity to the children, and allows the children to spread the income tax on the qualified plans over their lifetime. And at the death of the children, the CRAT or CRUT remainder passes to a charity or donor-advised fund selected by the client. This allows the client to achieve both tax and charitable goals.”

Shana Bielich (pronounced BEE-lick), CFP®, vice president and financial advisor at Coghill Investment Strategies, agrees and adds: “Charitable remainder trusts (CRT) work well for high net worth clients who want to give a significant amount of wealth to charity. Usually, it coincides with the sale of a business or some other financial event that results in a significant tax burden. Establishing a CRT can reduce taxes, reduce the size of an estate and create an income stream for to the client (or their child/children) with the remaining interest directed to the charity or charities of their choice.”

DelFiandra also recommends qualified personal residence trusts (QPRTs), which produce a lower taxable gift for clients, and split interest purchases of real estate, which require less of an investment for the children of clients.

Additionally, Foundation Director of Development Kate McKenzie outlines three strategies to maximize impact while enjoying marked tax benefits and Bielich adds her thoughts on those strategies.

- Give appreciated securities instead of cash. Gifts of appreciated stock may allow you to maximize your giving without having to realize capital gains tax. “Giving cash to charity is easier but is it the most tax-efficient way? Gifting appreciated securities that you have held for more than one year is a more tax efficient maneuver than giving cash. Let’s say I wanted to make a $100,000 gift and I chose to sell a stock with a cost basis of $50,000. If I sell the security, I would be hit with a 20% capital gains tax and possibly an additional 3.8% net investment income tax. This means my tax bill could be as high as $11,900. If I have no cash reserves to pay the tax bill, my charitable gift would be reduced to $88,100. BUT, if I gift the stock rather than selling it, my charity will receive the full gift, I avoid paying tax AND receive a charitable deduction.”

- Turn your IRA’s required minimum distributions (RMD) into an opportunity to create a designated, field of interest or scholarship fund. “If you don’t need the cash flow, and you are 70 ½ or older, consider a Qualified Charitable Distribution (QCD). With a QCD you can transfer up to $100,000 of your RMD to charity each year. This amount will not be considered a taxable distribution so you’re essentially lowering your taxable income. Lowering your taxable income may also help to reduce Medicare premiums as well.”

- Amplify your impact with your IRA. By considering planned gifts that make the Foundation the beneficiary of all or a portion of your IRA to establish or add to a fund. This will enable people to leave more to their causes and reducing the tax burden left for heirs. “Another tax savings strategy is to leave your IRA assets directly to charity and leave non-IRA assets your loved ones. Heirs of your non-IRA assets will be eligible for a step-up in tax basis to the fair market value as of the date of death. This allows the asset to be sold by your heirs with little or no income tax, providing more after-tax cash for heirs while satisfying your charitable intentions with IRA assets.”

All that said, inflation reminds on the minds of many. “Volatility is a normal part of investing.,” Bielich says. “Sure, this time may be a bit different, but we’ve experienced volatility before, maybe for different economic reasons, and we’ve been through, and recovered from, tough times before. History has shown us that the best way to get through periods like this is to remain focused on the long term.”

Fortunately, the aforementioned umbrella of investment opportunities can protect all while providing proven paths for philanthropy and safe harbor for their valuable assets.